Roof Types & Shapes for Insurance: How Your Roof Affects Premiums

A home in South Carolina featuring a synthetic CeDUR Walden roof, professionally installed by Allcon Roofing for long-lasting beauty and durability.

When most homeowners think about insurance premiums, they consider location, home value, or past claims. But did you know your roof's shape and material also play a key role in what you pay for home insurance? The type of roof over your head can affect your home's risk profile, durability, and repair costs—all factors insurers use to calculate premiums.

In this guide, we'll break down how different roof types and shapes impact your insurance, which options are the most insurance-friendly, and how choosing the right roofing material can help you save in the long run.

Why Roofs Matter to Home Insurance Providers

Your roof is your home's first line of defense against weather events like hail, wind, fire, and rain. Insurance companies assess how likely it is your roof will fail during these events—and how costly the damage could be. They reward homeowners with lower premiums for roofs that are durable, fire- and impact-resistant, and have lower repair costs.

In contrast, if your roof is made of fragile or outdated materials, has a complex shape, or is past its expected life span, you might face higher rates or even be denied coverage.

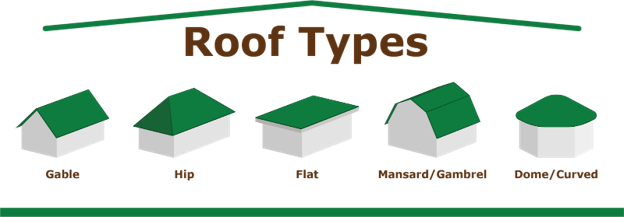

Roof Shapes and Their Insurance Impacts

5 Common roof shapes for homes and buildings.

Your roof's shape doesn't just affect aesthetics—it plays a major role in how insurers assess wind resistance, drainage efficiency, and overall risk.

Gable Roof

A classic triangular shape with two sloping sides. Gable roofs are common and cost-effective, but they can be vulnerable to high wind uplift. In hurricane-prone areas, insurers may charge higher premiums if the gable end isn't reinforced.

Hip Roof

With all four sides sloping downward to the walls, hip roofs are more aerodynamic and stable in strong winds. Because they hold up better in storms, insurance companies typically offer lower premiums for homes with hip roofs.

Flat Roof

Flat roofs are easier to build but come with drainage challenges. They are more prone to leaks and pooling water, leading to potential damage. Some insurers view flat roofs as higher risk and may increase premiums accordingly.

Mansard and Gambrel Roofs

These stylish designs often offer extra attic space or aesthetic appeal but can increase the surface area exposed to wind and hail. They also cost more to repair, which may translate to higher insurance rates.

Dome or Curved Roofs

Rare but architecturally interesting, dome-shaped roofs resist high winds well but are costly to construct and repair. Insurers may price policies higher due to limited material and labor availability.

Common Roof Materials and Their Insurance Implications

Let’s now explore how the material your roof is made of can directly affect your home insurance coverage and rates. From asphalt to synthetic options like CeDUR, each type comes with distinct benefits and potential drawbacks in the eyes of insurance providers.

Asphalt Shingles

The most common roofing material in the U.S. Asphalt shingles are affordable and easy to install but offer moderate resistance to impact and fire. Premium discounts may be available if shingles have high wind or impact ratings.

Wood Shakes

Natural wood shakes are beautiful but flammable and require more maintenance. In fire-prone areas, insurance providers often charge higher premiums or deny coverage without additional treatment.

Clay or Concrete Tiles

Tile roofs are durable and fire-resistant but heavy. The high cost of repairs and installation may impact premiums, especially if replacement requires specialized labor.

Metal Roofing

Metal roofs offer superior fire resistance, durability, and longevity. They're lightweight and resistant to extreme weather, making them a top choice for insurance savings in many regions.

Slate Roofing

Extremely durable and fire-resistant, slate is one of the most long-lasting options. However, its cost and weight may increase insurance premiums unless paired with structural reinforcements.

Synthetic Roofing

CeDUR synthetic shakes are gaining popularity as a roofing material that combines premium aesthetics with performance. They mimic the look of natural wood but deliver Class A fire resistance, Class 4 impact ratings, and extreme durability.

Insurance providers value CeDUR for its low-maintenance requirements and superior performance during wildfires, hailstorms, and high-wind events. Homeowners with CeDUR often enjoy better coverage options and long-term savings.

Additional Roof Features That Affect Insurance

Some lesser-known roofing factors can also affect your home's insurance profile. These include the age of your roof, what lies underneath it, and any additional systems that interact with it.

Roof Age: Older roofs (typically 20+ years) are seen as higher risk. Some insurers won’t fully cover roofs past a certain age unless replaced.

Underlayment & Decking: Updated underlayment and decking can boost water resistance and improve your insurance profile.

Roof Attachments: Skylights, chimneys, solar panels, or rooftop HVAC systems increase complexity and potential for damage.

Drainage Systems: Poor drainage (especially on flat roofs) can lead to water pooling and structural damage, impacting insurance costs.

How to Lower Your Premium with the Right Roof

Roofing decisions impact more than just curb appeal—they directly influence your home insurance rates and long-term maintenance costs. By selecting the right combination of roofing shape, material, and performance features, homeowners can unlock meaningful savings while enhancing property protection.

Upgrade to Impact-Resistant, Fire-Safe Materials

Insurance companies often offer discounts for roofing materials that carry certifications for hail resistance (Class 4 impact rating) and fire safety (Class A fire rating). These materials are less likely to incur damage during extreme weather events, lowering the likelihood of claims and saving insurers money—which can translate into lower premiums for you.

CeDUR: A Smarter Long-Term Roofing Investment

Slade Roofing replaced the old roof with a durable CeDUR Live Oak roof.

One of the best ways to reduce long-term insurance exposure and repair costs is to choose a material that excels in both durability and risk reduction—like CeDUR synthetic roofing shakes.

Here’s why CeDUR is increasingly favored by homeowners and insurance providers alike:

Class A Fire Rated: Ideal for wildfire-prone areas, CeDUR's proprietary fire-resistant technology delivers top-tier protection without sacrificing looks.

Class 4 Impact Rating: CeDUR is designed to withstand severe hail and storm conditions, helping avoid costly repairs and claims.

Lightweight & Strong: Easier to install without reinforcing roof structure, while delivering exceptional strength.

Natural Appearance: Mimics the beauty of real wood without the flammability, insect risk, or upkeep.

While synthetic roofing like CeDUR may have a higher upfront cost than asphalt shingles, the potential insurance savings, increased property value, and reduced lifetime repair expenses make it a strategic long-term investment.

Talk to Your Insurer Before You Replace Your Roof

Before upgrading or replacing your roof, check with your insurance agent to learn which shapes, materials, and features could help lower your premiums. You might be eligible for discounts or credits based on your region, roof pitch, or material certifications.

And if you're looking for a roof that blends safety, beauty, and long-term savings, ask your contractor about CeDUR. With its blend of luxury aesthetics and high-performance features, it's a top-tier choice for both protection and peace of mind.

Need help finding a roof that checks all the boxes for insurance, safety, and style?

Visit CeDUR.com to explore Class A fire-rated, impact-resistant synthetic roofing shakes built for homeowners who want the best of both worlds.