Will Insurance Cover a 20-Year-Old Roof? What Homeowners Need to Know

A professional inspector evaluates the condition of an older roof to help determine eligibility for homeowners insurance coverage.

An aging roof can create uncertainty when it comes to homeowners insurance. Renewing your policy, switching providers, or filing a claim can all be affected by the age of your roof, which may significantly influence the coverage you receive based on your insurer and policy terms.

In this guide, we break down what insurers look for, how coverage changes with age, and what to do if your roof is 20 years old or older.

Does the Age of Your Roof Affect Homeowners Insurance?

Yes. Insurance companies view older roofs as higher risk because they are more likely to leak, sustain storm damage, or fail during extreme weather. Many insurers consider a roof's age when determining:

Your eligibility for coverage

Your annual premium

Whether a claim is approved or denied

Whether your roof will be covered at replacement cost or actual cash value (ACV)

Roofs made of asphalt shingles typically have a life expectancy of 20–25 years, while materials like metal, tile, or synthetic shakes may last 40–50 years or more. As a roof approaches the end of its expected lifespan, insurers may offer limited or conditional coverage.

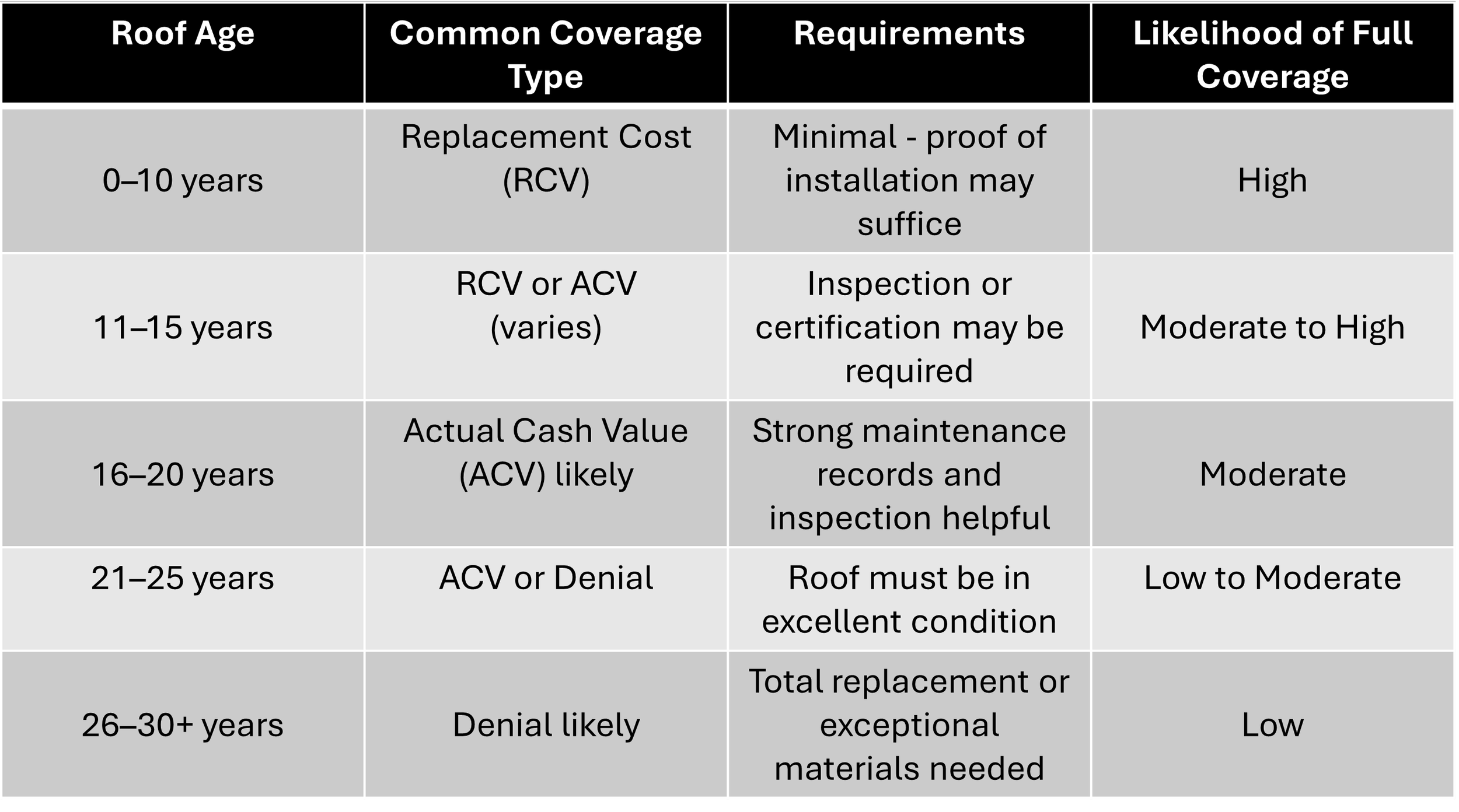

Roof Age vs. Insurance Coverage: What to Expect

To better understand how your roof's age can impact your insurance options, here’s a quick comparison:

Note: These are general trends and may not apply to every insurance provider or policy. Coverage can vary significantly, so it’s always best to review your policy or speak with your insurance agent directly.

Graphic representing potential insurance coverages based on roof age.

Disclaimer: This article is for informational purposes only and does not constitute insurance advice. Policy details vary widely. Always consult your insurance provider or agent to understand your specific coverage and options.

How Old Can a Roof Be and Still Qualify for Insurance?

There is no universal rule, but many insurance companies begin scrutinizing roofs around the 15-year mark. Common thresholds include:

15 years: May require an inspection or certification

20 years: May only qualify for actual cash value (ACV) reimbursement

25–30 years: Coverage may be denied altogether unless the roof is in exceptional condition

Well-maintained roofs with no signs of damage or deterioration may still qualify for coverage, especially if made of high-end or newer materials. Always confirm with your insurance provider to understand how roof age impacts your specific policy.

Regional and Climatic Factors Affecting Roof Longevity and Insurance Decisions

Where you live plays a major role in how long your roof lasts—and how your insurance company assesses its risk. Climate and regional weather patterns can accelerate wear, increase the likelihood of damage, and directly influence both your roof’s lifespan and your insurance options.

How Climate Impacts Roof Aging

Here's how different weather conditions can impact your roof over time:

Extreme Heat: Prolonged exposure to high temperatures can cause roofing materials, especially asphalt shingles, to warp, crack, or become brittle. Homes in hot, sunny regions may see roofs age faster than those in milder climates.

UV Radiation: Constant sunlight breaks down the protective layers of roofing materials, causing sealants to deteriorate and making shingles more prone to lifting and leaks.

Heavy Rain and Humidity: Persistent moisture can lead to mold, rot, and water infiltration, particularly if a roof is already aging or poorly ventilated.

Snow and Ice: In colder regions, freeze-thaw cycles and ice dams can cause shingles to crack or loosen, while the weight of accumulated snow may stress the roof’s structure.

High Winds and Storms: Areas prone to hurricanes, tornadoes, or strong thunderstorms face increased risk of wind-driven damage, such as missing shingles or torn flashing.

Hail: Hailstorms can dent, crack, or puncture roofing materials, especially on older roofs that have already lost some resilience.

Regional Considerations for Insurance

Insurance companies often adjust their coverage policies based on your region’s climate risks. For example:

Homes in coastal or wildfire-prone areas may face stricter requirements or exclusions for certain roofing materials.

In hail- or storm-prone regions, insurers may require impact-resistant roofing or limit coverage for older roofs.

Some providers offer discounts for roofs with high fire or impact resistance, especially in high-risk zones.

What This Means for Homeowners

If you live in an area with harsh weather or extreme climate conditions, your roof may not last as long as the manufacturer’s estimate. Insurers may scrutinize older roofs more closely, require frequent inspections, or limit coverage for certain perils. Choosing durable, weather-resistant materials and performing regular maintenance is especially important in these regions to maintain both your roof’s longevity and your insurance eligibility.

Will Insurance Cover a 20-Year-Old Roof?

In many cases, yes—but with caveats. If your 20-year-old roof is in good condition and hasn't led to prior claims, many insurance providers may still offer coverage. However, this coverage may come with limitations. For instance, your policy might reimburse you based on actual cash value (ACV) rather than the full replacement cost, meaning depreciation will be factored into the payout. Your insurer may also request a recent roof inspection or third-party certification to assess its condition.

You could face higher deductibles or premiums due to the increased risk associated with older roofs. While a well-maintained 20-year-old roof can still qualify for insurance, it will be closely evaluated for signs of wear, granule loss, and overall structural integrity.

Every policy is different, so it’s always best to check with your agent for the most accurate guidance.

What About Older Roofs?

As roofs age beyond the 20-year mark, insurance companies become even more cautious. Here's what to expect when your roof is 25 or 30 years old.

Will Insurance Cover a 25-Year-Old Roof?

Many insurers may deny full coverage for roofs 25 years or older, especially if made of asphalt. If covered at all, it may be for ACV only, meaning the payout would be significantly lower than the cost of a full roof replacement.

Will Insurance Cover a 30-Year-Old Roof?

It’s rare. A 30-year-old roof is often beyond its useful lifespan, especially if it hasn’t been maintained or updated. Most insurers will not offer coverage unless it has been recently replaced or made from exceptionally long-lasting materials.

How to Get Homeowners Insurance with an Old Roof

If your roof is older but in good condition, you can still secure insurance by taking the following steps:

Schedule a professional inspection to prove the roof is sound

Provide documentation of maintenance, repairs, or updates

Upgrade materials like adding impact- or fire-resistant shingles

Shop around to compare insurers with more flexible roof policies

Consider replacing the roof to regain full coverage eligibility

Insurance Claim on a 20-Year-Old Roof: What to Expect

If you file a claim for roof damage, your insurer will evaluate:

The cause of the damage (storm, hail, tree impact vs. age/wear)

The current condition of the roof

The age of the roofing material

Most older roofs will only qualify for Actual Cash Value reimbursement, which deducts depreciation. That means a 20-year-old roof could result in a much smaller payout than expected.

When Will Insurance Deny Roof Coverage Based on Age?

Insurers may deny coverage or limit payouts based on several key factors. If the roof exceeds a certain age—commonly 20 years or more for asphalt shingles—it may no longer be eligible for full replacement cost coverage.

Visible signs of long-term neglect, such as missing shingles, curling edges, or persistent leaks, can also trigger denial or limited reimbursement. If the damage is purely cosmetic—such as faded shingles with no structural impact—insurers may not approve the claim.

Additionally, if there are unresolved issues from previous claims or a history of repeated damage, this could negatively affect your eligibility. In some cases, insurers might still offer coverage for older roofs but exclude protection against wind or hail damage specifically. Coverage terms vary, so speak with your insurer to understand your exact limitations.

Does Replacing an Old Roof Lower Your Insurance Premium?

Yes. Installing a new roof can significantly benefit your homeowners insurance. It helps reduce your overall risk profile, which may lead to a lower annual premium. A new roof also restores your eligibility for replacement cost coverage rather than actual cash value, ensuring better reimbursement in the event of a claim.

Using upgraded materials—such as those that are impact-resistant, fire-rated, or energy-efficient—may qualify you for extra discounts. Always notify your insurance provider once your roof is replaced to maximize available coverage and savings.

Upgrade to Longer-Lasting Materials Like CeDUR

CeDUR Walden roof installed in Denver, Colorado, captures the charm of natural cedar shake while offering superior durability.

If your roof is approaching the 20–30 year mark, replacing it with longer-lasting, high-performance materials can significantly improve your chances of securing full insurance coverage. One standout option is CeDUR synthetic roofing.

CeDUR shakes offer the timeless appearance of real wood while providing modern protection that appeals to insurers:

Class A fire resistance for peace of mind in wildfire-prone areas

Impact resistance against hail, falling branches, and storm debris

Moisture resistance to prevent rot and water infiltration

Lightweight and durable with minimal maintenance required

Unlike asphalt shingles that may only last 20–25 years, CeDUR roofs are engineered to deliver decades of performance with far fewer risks—qualities that homeowners and insurance companies both appreciate.

Replacing an aging roof with a material like CeDUR not only improves your home's resilience and curb appeal but may also restore eligibility for replacement cost coverage and reduce insurance premiums.

Age Matters, but So Does Maintenance

While roof age is a major factor in insurance decisions, it's not the only one. A well-maintained 20-year-old roof with quality materials can still qualify for coverage, while a neglected 15-year-old roof might not.

For the best results, keep detailed records of maintenance and work with both a reputable roofing contractor and insurance agent to understand your options. When in doubt, a proactive replacement may be the smarter long-term investment.

Ready to Replace Your Aging Roof?

Before and after: A dramatic transformation featuring CeDUR’s Live Oak synthetic shakes installed by Slade Roofing, showcasing the improved durability, curb appeal, and weather resistance of the new roof.

If your roof is nearing the 20-year mark—or already past it—it may be time to consider an upgrade. Choosing a durable, insurance-friendly material like CeDUR can restore your coverage, enhance your home’s value, and provide peace of mind for years to come.

Visit CeDUR.com to explore design options, learn about installation, and find a contractor near you.

Disclaimer: This article is for informational purposes only and does not constitute insurance advice. Policy details vary widely. Always consult your insurance provider or agent to understand your specific coverage and options.